Every company needs capital to start its business and the capital is raised by issuing shares. A person or entity that subscribes to the shares of the company and pays the respective amount against the shares allotted to them is called the shareholder. The cumulative amount of money that is raised by a company from its shareholders by way of issuing shares is called Share Capital.

A company needs to mention the maximum amount of share capital known as Authorised Capital that it wishes to raise in their MoA (Memorandum of Association) at the time of incorporation of the company. The company should report changes to Authorised Capital & Paid-up Capital to MCA from time to time.

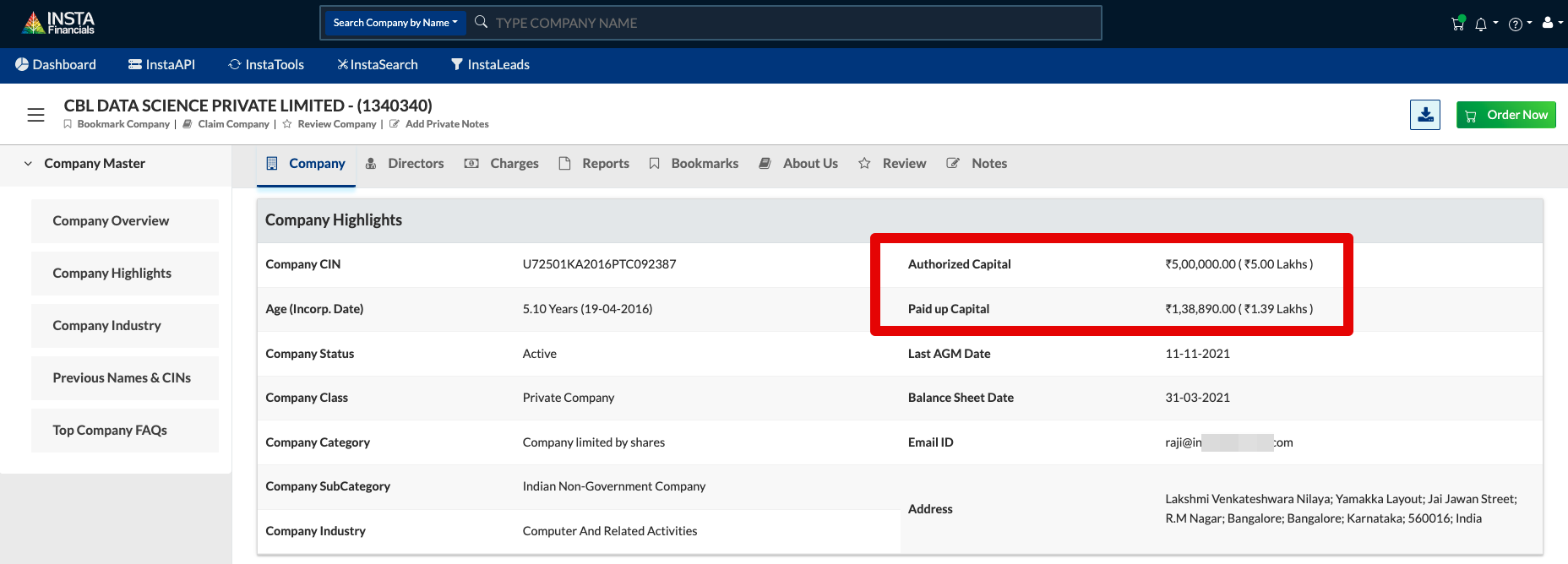

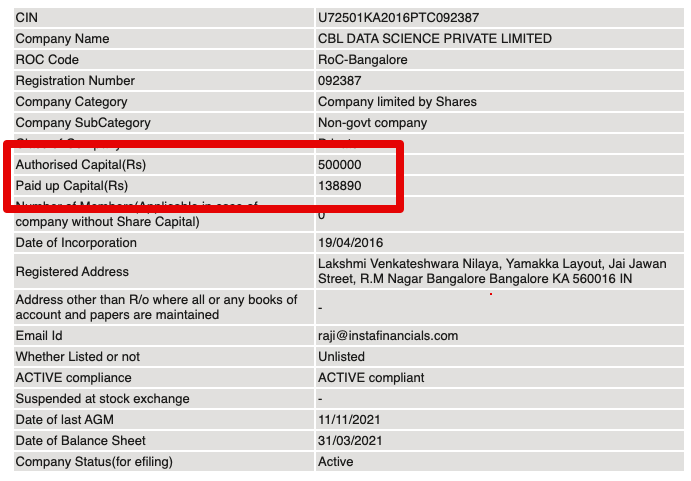

Any user can view the Authorised Capital & Paid-up Capital details of any Indian company for free on the Ministry of Corporate Affairs (mca.gov.in) or on InstaFinancials.

What is the Authorised Capital of a Company?

Authorised Capital is the maximum amount of the share capital of a company is authorised to raise by issuing shares to its shareholders. Every company needs to mention the Authorised Share Capital amount in its Memorandum of Association (MoA) at the time of incorporation of the company.

The company can increase or decrease the authorised share capital based on its requirement.

Definition of Authorised Capital as per Companies Act, 2013

“authorised capital” or “nominal capital” means such capital as is authorised by the memorandum of a company to be the maximum amount of share capital of the company;

(Companies Act 2013, 2. Definitions. Sl. No. (8))

“called-up capital” means such part of the capital, which has been called for payment

(Companies Act 2013, 2. Definitions. Sl. No. (15))

What is the Paid-up Capital of a Company?

Paid-up capital is the actual amount of money the company has received from the shareholders for the shares allotted to them. Generally, the company issues new or fresh shares to raise the paid-up capital. As per the amendment in the Companies Act, 2013, there is no minimum paid-up capital requirement for Private & Public Limited Companies. Prior to the amendment Rs, 1 Lakh and Rs 5 Lakh was the minimum paid-up capital for Private & Public companies respectively.

The paid-up capital of the company can never be more than the authorised capital of the company. If the company needs more capital than its current authorised capital then it needs to increase its authorised capital in order to raise further capital from its shareholders.

Definition of Paid-up capital as per Companies Act, 2013

“paid-up share capital” or “share capital paid-up” means such aggregate amount of money credited as paid-up as is equivalent to the amount received as paid-up in respect of shares issued and also includes any amount credited as paid-up in respect of shares of the company, but does not include any other amount received in respect of such shares, by whatever name called;

(Companies Act 2013, 2. Definitions. Sl. No. (64))

Example to Understand Authorised & Paid-up Capital

Ravi Builders is planning to build a gated community of 500 apartments. The Company has estimated that the project cost will be around Rs 500 Cr. Out of that initially, the company requires Rs 250 Cr and after 2 years another Rs 250 Cr will be required.

Promoters have registered the company with a maximum capital of Rs 500 Cr and present received capital as Rs 250 Cr by allotting shares to the shareholders.

In this example, the maximum capital required by the company that is Rs 500 Cr is called the Authorised Capital & Rs 250 Cr, the actual amount that is presently received is called Paid-up Capital.

The authorised capital is the maximum value of the shares that a company is legally authorised to issue to the shareholders. Whereas, paid-up capital is the amount that is actually paid by the shareholders to the company against the shares allotted to them.

Knowing these terms and understanding interrelation is very important for Company Directors to plan their business and the funds required for business.

Further, a company requires to comply with legal regulations based on authorised capital and paid-up capital. Having an idea of such limits will be very helpful for company Directors to make decisions and comply with legal requirements.

Case scenario – Business requirement – Authorised and paid-up capital

| Current Authorised Capital | Current Paid-up Capital | Company Requirement | Action | Total Paid-up capital (after Action) |

| 500 Cr. | 250 Cr. | 100 Cr. | Yes, the company can increase its paid-up capital | 350 Cr. |

| 500 Cr. | 350 Cr. | 100 Cr. | Yes, the company can increase its paid-up capital | 450 cr. |

| 500 Cr. | 450 Cr. | 100 Cr. | No, the company is not allowed to take the funds- as the Authorised capital is 500Cr. (paid up is exceeding 500 Cr.) | First, increase authorised capital by 50 Cr, then obtain 100 Cr. To make paid-up capital 550 Cr. |

At any point, the paid-up capital of a company can never be more than its authorised capital but it can be equal to the authorised capital. On the other hand, a company is not authorised to issue shares beyond the authorised share capital.

10 Important Points Related to Authorised & Paid-up Capital

- The authorised capital is mentioned in the Memorandum of Association of the Company. (There is no requirement to mention paid-up capital).

- The Company requires to pay government fees and stamp duty based on the Authorised capital of the company (click here to know the amount of fees and stamp duties based on authorised capital)

- Applicability of certain audits (CARO/ Secretarial audit etc.) will be based on paid-up capital.

- When new entrepreneurs want to start a business they have to decide their business requirement and fix Authorised capital (of course ready to pay fees and stamp duties)

- The authorised share capital doesn’t have any monetary impact on the company until it’s issued and paid-up.

- Paid-up capital is disclosed under shareholder funds on the balance sheet (Financials)

- For calculating the Debt to equity ratio (which is the industry KPI to assess debt risk) paid-up capital is used.

- The Companies Act has removed the criteria for the procurement of a minimum amount of paid-up capital. That means the registered companies would no longer be required to procure minimum paid-up capital.

- Through Paid-up capital one can know the market cap of the company.

- The Compliance the company should follow depends mostly on the paid-up share capital of the company and is sometimes based on Authorised share capital.

How to Revise the Authorised Capital and the Paid-up Capital of Your Company?

Articles of Association (AoA) contains the rules and regulations regarding the internal workings of the company. It also contains the provision to increase or reduce the authorised capital of the company.

If there is provision to increase or decrease the authorised capital then you can proceed with the following procedure. If there is no provision, then the AoA needs to be amended to accommodate the alteration of the authorised capital.

In order to revise the authorised capital, you need to obtain the board approval, get the resolution passed to revise the authorised capital. Then proceed to file Form SH-7 and Form MGT-14 as applicable along with the stipulated fee within 30 days from the resolution being passed by the company.

How to Check Authorised Capital of a Company?

Steps to check the Authorised Capital on InstaFinancials

- Visit InstaFinancials.com

- Search the company name

- View the Authorised Capital of the company for free (Click on update company, to see the latest Authorised Capital of the company.)

Steps to check the Authorised Capital on MCA

- Visit mca.gov.in

- Visit MCA Services → Master Data → View Company / LLP Master Data

- Click on Search Icon

- Type company name and click on the search icon

- Select the company that you are looking for

- Enter the characters shown in the image

- Click on submit

- View the Authorised Capital of the company for free

How to Check Paid-up Capital of a Company?

Steps to check the Paid-up Capital on InstaFinancials

- Visit InstaFinancials.com

- Search the company name

- View the Paid-up Capital of the company for free (Click on update company, to see the latest Paid-up Capital of the company.)

Steps to check the Paid-up Capital on MCA

- Visit mca.gov.in

- Visit MCA Services → Master Data → View Company / LLP Master Data

- Click on Search Icon

- Type company name and click on the search icon

- Select the company that you are looking for

- Enter the characters shown in the image

- Click on submit

- View the Paid-up Capital of the company for free

FAQs Authorised Capital & Related to Paid-up Capital

- Can Authorised Capital be increased or decreased?

- Yes, the authorised capital of the company can be increased or reduced.

- Can Authorised Capital & Paid-up Capital be the same?

- Yes, when the company raises paid-up capital equivalent to the authorised capital of the company from its shareholders, the paid-up capital and authorised capital will be equal.

- Can Paid-up Capital be more than authorised capital?

- No. Authorised capital will always be higher than the paid-up capital.

- Where to find the authorised capital and paid-up capital of a company?

- You can find the authorised capital and paid-up capital information of the company for free on InstaFinancials & mca.gov.in

- Where can we find the list of shareholders of a company from whom the company has raised the paid-up capital?

- You can find the shareholders information of any company by paying the nominal amount on mca.gov.in or InstaFinancials.com

Statistics of companies by paid-up capital

| Paid-up Capital Range | No of Companies |

| 0 – 1 Lakh | 17,03,839 |

| 1 Lakh – 5 Lakhs | 3,09,894 |

| 5 – 25 Lakhs | 2,58,493 |

| 25 Lakhs – 1 Crore | 1,44,874 |

| 1 Crore – 5 Crores | 92,798 |

| 5 – 25 Crores | 31,738 |

| 25 – 100 Crores | 8,770 |

| 100 – 500 crores | 3,065 |

| 500 crores+ | 1,119 |

| Total No of Companies | 25,54,590 |

Reach out to CS@InstaFinancials.com for more statistical information.